Super Capacitors

Ionic holds the exclusive worldwide licence to commercialise the key intellectual property (owned by Monash) that underpins our supercapacitors work.

Ionic aims to begin generating revenue from our energy storage and photo-voltaic products by 2019.

Technology

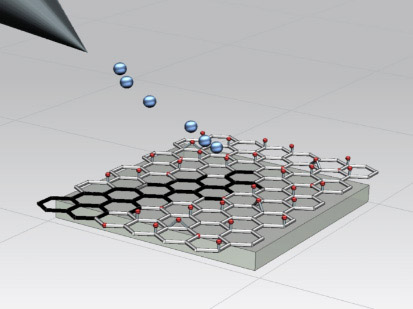

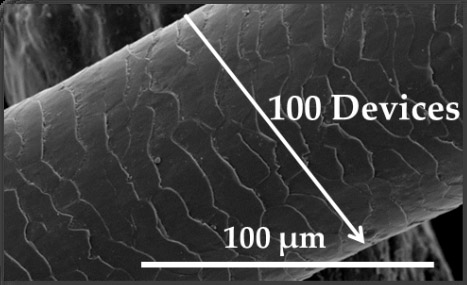

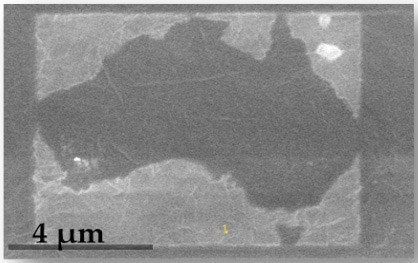

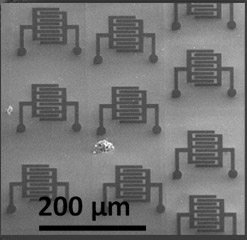

Ionic’s planar super-capacitors form the basis of our energy storage products. Our research suggests they are smaller, better, faster and have a range of other superior features to existing products: high resolution; small feature size; high throughput; complex geometries; and high conductivity.

Ionic has, for five years, been involved in work being done by Monash on planar super-capacitors using a direct-write technology that employs a focussed ion beam.

Ionic considers that super-capacitors and nano-capacitors are the next step in the evolution of energy storage. Research and development expenditure on these devices is advancing quickly and the research indicates these devices have many advantages over current battery technology. Chemical batteries are a fairly mature technology that has limited scope for further improvement. This aging technology is likely to be overtaken by radically different energy storage systems based on new physics that will greatly exceed the performance limits of chemical batteries.

Ionic Industries is fortunate to be in on the ground floor of this potential technology revolution and, despite significant competition, we aim to be a major player in its development.

Markets

Our super-capacitor products will seek to address growing markets for energy storage and target renewables, transportation and consumer electronics.

Energy Storage Market

In recent years there has been an accelerating realisation by world leaders, international foundations and mega-funds that the world cannot continue to burn fossil fuels at the rate at which it is now doing. The common consensus amongst all of these entities is that the process of decarbonisation of the economy must start and must start now. This has thrown the spotlight on renewable energy resources. The most efficient way of tapping into these renewable resources and supply the energy needs of the world is to convert them to electrical power. This is easily done but the renewables are invariably intermittent as the sunshine is only effective during the day and when there is little cloud cover and some days are calm and some are windy. This problem of intermittency can be overcome with energy storage, but which to date has not been economically available.

But with the push to decarbonise the economy, the race is on to find economical forms of energy storage propelling the global energy storage market to rise to represent potentially $50 billion in annual sales by the year 2020, according to Lux Research, at a predicted compound annual growth rate of 8%.

One of the sectors of the economy that consumes prodigious quantities of fossil fuels is the transportation sector. Energy storage for this sector is in the form of on board car batteries that are charged via the electricity grid. The displacement of fossil fuels in this sector with renewables fed from the electricity grid will generate much of the predicted growth, which will rise to represent $21 billion in annual sales by 2020, according to Lux Research, thus narrowing the gap between the transportation sector and the consumer electronics sector, which is predicted to rise to $27 billion in annual sales by 2020.

The remainder of the global market is forecast to be filled out by in the home battery packs paired with photovoltaics on your roof to smooth out the intermittency of renewables, which is expected to rise to $2.8 billion. The transport sector is well on its way to displacing consumer electronics as the biggest user of energy storage. As that happens, it is likely to lead to further economies of scale and a new round of cost reductions, which will impact on in the home battery packs as well.

Renewable Energy Applications

There is little argument that at the rate civilisation is consuming fossil fuels, it is only a matter of time before we run out of them or economic extraction becomes unviable. The question is: how long do we have? Some of the more pessimistic scenarios indicate that it is only 30 to 40 years or just less than two generations. So how will we feed, clothe and supply energy to a projected 10 to 12 billion people?

Clearly we will need to find an alternative source of energy. In the electricity sector, renewables, in particular wind and solar, are a viable solution. These sources are already a significant part of the energy mix in a number of countries and are expected to account for an increasing share of the world’s electricity output in the future. But these renewables are intermittent in that solar photovoltaics (PV) do not generate electricity at night or when there is cloud cover; when the wind does not blow, no windmill electricity is produced.

So, for these renewable sources to supply us with reliable and continuous power, electricity that is generated when there is a surplus has to be stored and released when renewables are not generating. With the transformation of electricity grids from centrally supplied legacy grids to smart-grids, this storage in the form of in-home battery banks and grid banks can now be deployed and activated in the networks. So, renewable energy generation systems, paired with advanced energy storage solutions such as super-capacitors may represent the next stage of evolution in this field.

Distributed storage overcomes the intermittency limitations of renewables, smoothing out the peaks and troughs of the load profiles, thus creating an efficient and reliable integrated energy system that displaces fossil fired base load plant. Storage also improves the distribution grids’ stability, where the potential for regional balancing can be limited when storage is unavailable.

Given this fundamental role that distributed storage is likely to play in the emerging smart-grids, global demand for distributed storage is expected to soar over the next two decades as renewables become increasingly cost competitive and a larger component of the generating plant mix.

Much progress is being made in storage technologies, but currently they are still developing. Some of the best progress has been made with solar photo-voltaic cells (PV) paired with battery storage. At the grass roots level, solar PV paired with battery storage has already reached the viability threshold in a number of countries. For some consumers, it is now less expensive to self-generate electricity using solar PV paired with storage and supplemented with embedded generation than it is to use electricity from the grid.

According to Navigant Research, there were 362.8 MW of energy storage projects announced worldwide in 2013-2014, an almost equal distribution between North America, Asia Pacific, and Western Europe. Navigant Research expects global installed energy storage for the grid and ancillary services power capacity to grow from 538 MW in 2014 to 21 GW in 2024. It predicts that worldwide revenue from energy storage will increase from $675 million in 2014 to $15.6 billion in 2024.

Three factors contribute to a compelling case for decentralised, stand alone, residential applications:

- Where retail energy prices are high;

- Where compensation for electricity fed into the grid is low; or

- Where government support for solar PV paired with battery storage is available.

This is improving the economics of distributed storage to the point where cost reductions are beginning to track the profile of solar PVs experienced in the last five years, making off-grid storage the preferred option for many consumers and consequently reducing the reliance on fossil fuels.

If we are successful in executing our plans, we believe that Ionic’s supercapacitor technology could place us at the forefront of technological innovation in this critical field of human endeavour.

Transportation

Transportation is predicted to be the fastest growing application of energy storage technologies, rising to annual sales of USD 21 billion by 2020;largely due to the increasing use of electric vehicles. The rapidly changing market for electric vehicles (EVs), which includes hybrid, plug-in hybrid, and battery electric vehicles (HEVs, PHEVs, and BEVs), is a small but important part of the global automotive industry. Many governments worldwide are keen to see increasing penetrations of EVs due to the environmental, economic, and energy security benefits they provide. Consequently, governments have both pushed automakers to develop EVs and incentivized citizens to buy them.

Even based on conservative estimates, the global EV market is expected to grow from 2.7 million vehicle sales in 2014 to 6.4 million in 2023. Several factors are fuelling this growth, including consumer demand for less-expensive operational costs (compared to gasoline-powered vehicles), consistent government policy, multiple new models from major automakers, and lower battery prices.

As always, favourable economics are the prime ingredient for market expansion. Gasoline prices are projected to increase at a 7.2% Compound Annual Growth Rate (CAGR) between 2013 and 2020, while hybrid vehicle battery pack prices are expected to decrease by more than 20% by 2020 as advanced research unlocks battery innovations. Considering battery packs can represent up to half of EV prices, while the cost to recharge a car with electricity is a fraction of the cost compared to refuelling with gasoline, it’s clear why lower EV operational costs are a major market driver. Ionic’s super-capacitors could inject new capabilities into this market and contribute positively to market growth while also having the potential to capture significant market share.

However, beyond better economics, electric-powered vehicles are becoming more mainstream, with more options available to consumers. From established models like the Chevy Volt, Nissan Leaf, and Tesla Model S to new options like the Chevy Spark EV and hybrids from most major automakers, EVs are available in almost every price and performance range.

Steady government policy support also has a role in the rise in EV adoption, with currently available tax incentives worldwide to remain steady and provide financial support for consumers. At the same time, stricter fuel economy and emissions regulations encourage automakers to continue expanding low-carbon options.

So, for a range of reasons, we expect that if we are successful in product development, there will be a strong and growing transportation market to underpin demand for our graphene super-capacitors.

Consumer Electronics

Consumer electronics will continue to be a major market for energy storage applications. We predict that Ionic’s super-capacitors will enable devices to hold much more energy in the same or lesser volume, have higher peak power, be fully rechargeable within minutes, and live longer than current battery technologies. As with transportation applications, it is hoped that Ionic’s work in this field (in collaboration with Monash researchers)will involve the introduction of exciting new technologies into markets that are already growing at a rapid pace. The ever-growing popularity of smartphones, allied with a gradual increase in their battery capacity, is forecast to see this market segment growing sales at a 12% growth rate to $8.4 billion in 2020. Tablet computers will follow with a 6% predicted growth rate to $12 billion, the single largest energy storage consumption by a single application. Overall, the energy storage market for smart portable devices as laptops, smartphones, tablet PCs, digital cameras, wireless sensor networks and radio frequency identification (RFID), is forecast to be achieve combined annual sales of$86 billion per annum by 2023.

Lithium-ion batteries are currently the dominant technology in the energy storage space; this is because of their superior energy density characteristics compared to other existing competitor products. The consumer electronics industry has pushed their production to the scale of billions, and consequently through economies of scale has enabled an optimisation of the supply chain and reduced price. However, lithium battery technology capabilities are being challenged by the modern multifunctional portable devices which are requiring increasingly higher performance in terms of power density. Whilst current research and development pathways aim for the emergence of a new generation of high energy density technologies, alternative energy storage technologies are challenging the dominance of lithium batteries. This is the case with super-capacitors, which have disruptive potential as an emerging energy storage technology whose characteristics make them strong candidates for satisfying those specific functions where lithium batteries underperform.

So, with our super-capacitor technology, we aim to launch a viable product into a rapidly growing market consumer electronics market where new technology is critical to both meeting existing customer requirements and also driving capacity for further innovation within the broader segment.

Next steps

Monash has made a number of breakthroughs in this field over the last five years positioning us to move forward with an aggressive commercialisation schedule.